The government’s additional revenue measures come amid a massive expansion of Cayman’s civil service.

The government has framed the fee hikes as an effort to rebalance the economy and ensure Caymanians benefit from the islands’ prosperity. But analysis suggests that the biggest winners will be the country’s civil servants.

Increased spending

The last month has seen a series of red flags highlighting the steady increase in government spending. The most obvious was Appropriation Bill (Financial Years 2026 and 2027) 2025, which allocated $2.5 billion of spending for the two-year period – a record expenditure for the Cayman Islands.

Then on 12 Nov. the government released its unaudited Q3 financial report. The headline figures looked good, with a reported $137.4 million surplus for the entire public sector. Yet a more telling indicator is that spending over the first three quarters of 2025 increased by $72.9 million, compared with the same period in 2024, while income only increased by $56.5 million over the same period.

These were unaudited accounts that don’t cover the full year, yet the relative increase of expenditure compared to income may be one factor driving the government to raise fees.

But increased public spending is a trend that predates the current government. On 3 Oct., Auditor General Patrick Smith published a report on the financial statements of public bodies in 2024 that highlighted the consistent expansion of public spending.

The total expenditure of core government entities hit $639 million in 2024, up 41% from $453 million in 2020. The spending for statutory authorities and government companies also increased over the same period, reaching $617 million in 2024, up from $421 million in 2020.

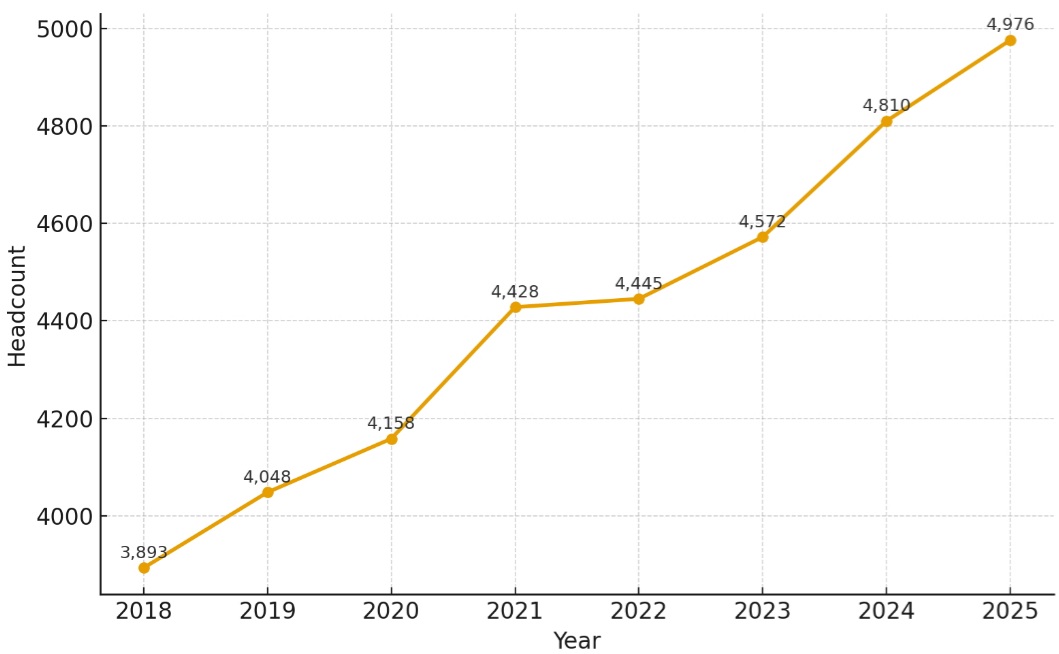

Civil service increases

Although it is well known that government spending is increasing, what is less understood is that much of this spending goes towards paying the wages of civil servants.

The report from the Office of the Auditor General of the Cayman Islands found that personnel costs account for 68% of the total annual spend for core government entities.

What’s more, those costs are rising fast, jumping by 38% between 2020 and 2024. The same rate of increase was seen for personnel costs for statutory authorities and government companies.

That relentless increase means that regardless of which government is in power, the state must find a way to increase revenue.

“Every government must balance its budget, and revenue measures were expected, given the rising costs of public services and infrastructure,” said Wil Pineau, CEO of the Cayman Islands Chamber of Commerce.

“The exponential growth of our population and civil service and infrastructure strains, require funding that must be met from somewhere,” said Nick Joseph, founder of relocation consultancy Reside Cayman.

“Successive governments have taken the financial services sector and tourism sector as unlimited sources of money to provide for an ever-expanding state sector,” said Simon Cawdery, director at HLX Management.

Hidden civil service costs

But the true cost of Cayman’s expanding civil service is far higher than what appears in the accounts. That’s because each civil servant has a wide range of benefits, including health insurance, pension and education rights for their children (for non-Caymanian civil servants), that add to their overall cost.

The danger of these hidden liabilities is that they are set to grow, regardless of government policy. “The healthcare liability will continue to grow due to demographic factors e.g. people living longer, more persons becoming Caymanian and eligible for the benefit, the general rise of healthcare and inflationary factors,” said Smith in a 13 Oct. interview.

So even when a government implements a ‘hiring freeze’, the cost of future health care and pension liabilities will continue to grow. “Some of the benefits associated with employment with the government, including lifetime health care for many civil servants after a decade of service, will be causing significant strain on government’s coffers,” said Joseph.

Reform needed

The solution would be a major reform of the civil service, said Cawdery. “There needs to be innovation in health care insurance. The current system is wildly inefficient, prone to huge unnecessary costs to the detriment of not only government, but everyone in Cayman. At a stroke, addressing this could surely reduce long-term costs.”

He added, “Education is another area; government schools are substantially less efficient than private sector schools. They pay their teachers more and obtain worse educational outcomes. Surely that’s another area ripe for innovation and real change.”

There appears to be a broad consensus across the business community that Cayman’s ever-expanding civil service could be more efficient.

“Before looking toward fee increases, the Chamber would always encourage continued focus on efficiency, better service delivery, and economic growth as the first tools for raising revenue,” said Pineau. “Broader consultations that consider long-term competitiveness, cost of living, and the cumulative burden on businesses would also help ensure that any revenue solution is sustainable.”

Such reforms don’t mean that the government wouldn’t raise fees. But instead, it would have more freedom on how to spend them, with some suggesting that Cayman should follow the example of other wealthy nations in setting up a sovereign wealth fund.