The knock-on effects of country-specific US tariffs that were a part of US President Donald Trump’s ‘Liberation Day’ trade policy have hit Cayman’s import-reliant economy, with local businesses reporting rising costs and impacted supply chains.

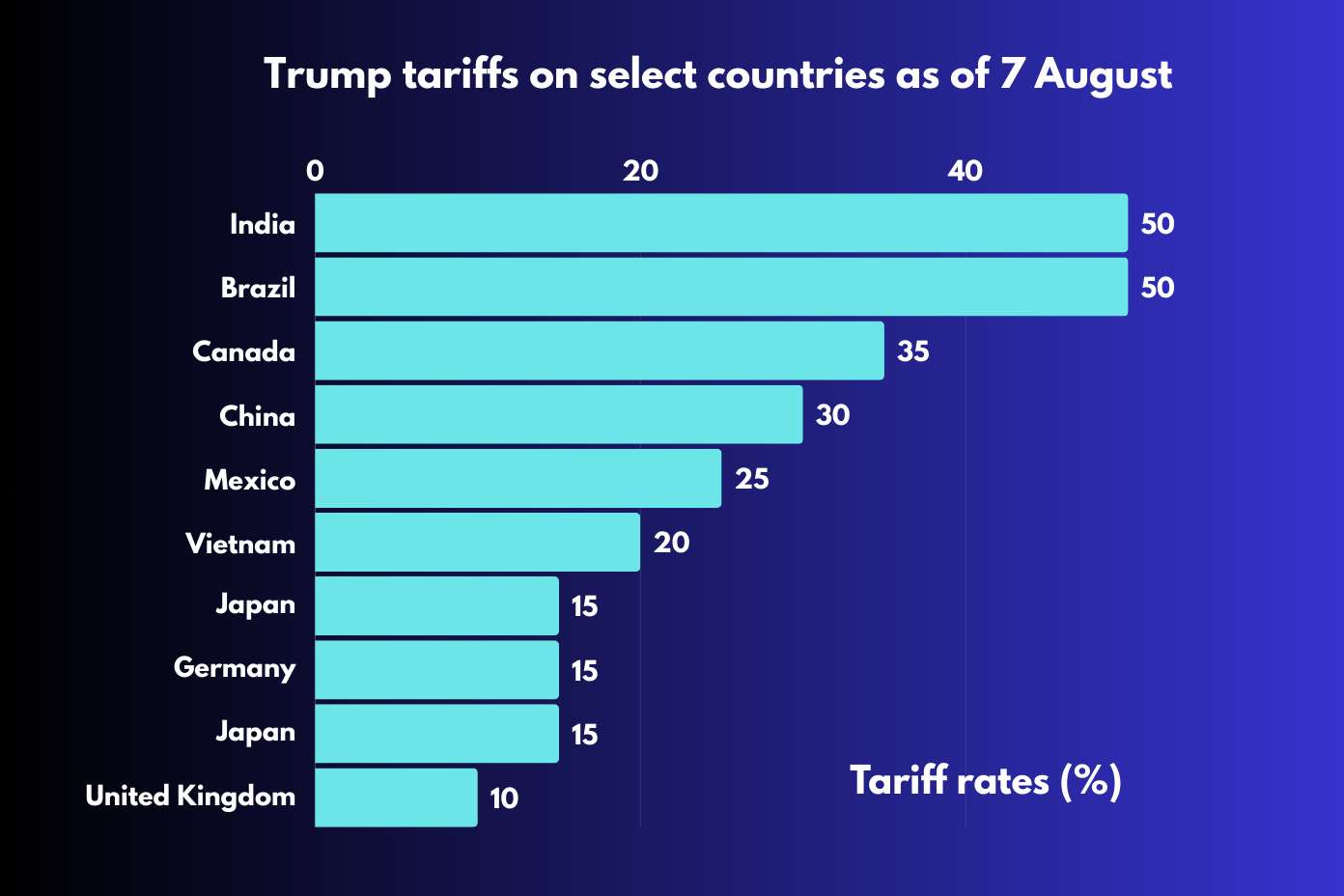

On 7 Aug., the United States officially imposed tariffs on imports from more than 90 countries, pushing America’s average effective tariff rate to 18.6% – its highest level since 1933, according to the Budget Lab at Yale University. Just a year ago, that rate stood at 2.4%.

For Cayman, which depends heavily on US trade routes for goods, the impact is already being felt. Over 80% of Cayman’s imports arrive here via the US, which means that any goods derived outside the US may become more expensive here if they were first transported through the US.

Local businesses feeling the squeeze

At MGJ Motorsport, a high-end European auto repair and performance shop, owner Macario Tinio Gallo Jr. said the tariffs are driving up the price of imported parts, which are primarily sourced from manufacturers in Germany, the United Kingdom, Dubai and Japan.

“While some shipments come directly to the Cayman Islands, others are routed through the United States due to logistics efficiencies and availability,” he said in an interview with the Compass.

“US tariffs on certain categories of automotive parts – especially those originating from Europe – have contributed to higher costs. Even when we source directly from Europe, shipments routed through the US often incur additional fees or tariff-related adjustments.”

To cope, his company is diversifying its supply chains, sourcing from multiple regions and holding onto a larger inventory of high-demand parts.

“Ultimately, our focus is on absorbing as much of the increased cost as possible,” he said.

Ken Moore, who owns businesses LED Specialists and Office Furniture Ltd., has seen costs climb in different ways.

Office furniture shipped directly from China via Jamaica has dodged US tariffs, giving Office Furniture Ltd. an edge over many competitors that receive shipments from the United States.

“The tariffs will create a positive benefit to our Office Furniture business,” Moore said, while still acknowledging that the impact on the wider economy would affect his business indirectly.

Moore’s LED business, on the other hand, which sources from both US and Chinese companies, has been more directly impacted.

“Most US suppliers started hiking prices six months ago and more increases are on the way,” he said.

“For the Chinese manufacturers that we buy from, the cost of shipping items by sea has not changed but the cost to ship by air to Cayman [via Miami] has gone up.”

Moore shared that air-freight costs from China through Miami have incurred a 35% duty.

“This is no longer feasible,” he said, speaking of air-freight facilities, adding that many Chinese manufacturers have been shutting their US warehouses because of a slowdown in sales caused by tariff uncertainty.

Moore advised that for LED Specialists, goods coming in from the US would continue to experience higher prices whereas goods coming from Asia would not be impacted.

The construction sector is also feeling the pinch, with 25% tariffs on steel and aluminium expected to drive up building costs in an already strained housing market.

Megan De Freitas, a quantity surveyor at NCB Group, said that while the company itself has not yet been directly affected, several suppliers and subcontractors have raised concerns.

“Recently, one of our railing subcontractors said he was anticipating an overall 50% increase in aluminium railing costs, driven by rising aluminium prices combined with tariffs,” De Freitas explained.

Pamela Coke-Hamilton, executive director of the International Trade Centre, cautioned that Cayman’s reliance on US trade routes from China could result in “significant increases in costs for the final sale to consumers”.

She advised businesses to seek alternative channels through Canada, Panama or directly from Europe, noting that trade agreements may provide duty-free opportunities for certain imports.

‘Almost everything we import to resell is affected’

In May, the Cayman Islands Chamber of Commerce surveyed its members and found tariffs were hitting nearly every sector “from construction materials and electronics to feminine care products and frozen berries”.

“Almost everything we import to resell is affected,” one respondent said. “Even goods from Jamaica and Europe are creeping up in price.”

The survey revealed that delays in shipping as well as rerouting through non-US ports were adding time, expenses and other complexities to the business operations of its members.

“Minimum order quantities, freight logistics, and the sheer complexity of switching suppliers are real hurdles,” said the chamber, highlighting one member’s experience that even when trying to reroute through alternate countries, suppliers still ended up routing through the US.

“It’s a puzzle,” they said.

Members indicated that they are either passing costs on to consumers or trying to absorb them – an unsustainable strategy for many. Some companies said that this resulted in delayed projects, frozen hiring or cut hours, while others warned that persistent cost hikes could make Cayman “not worth it” for long-term investment.